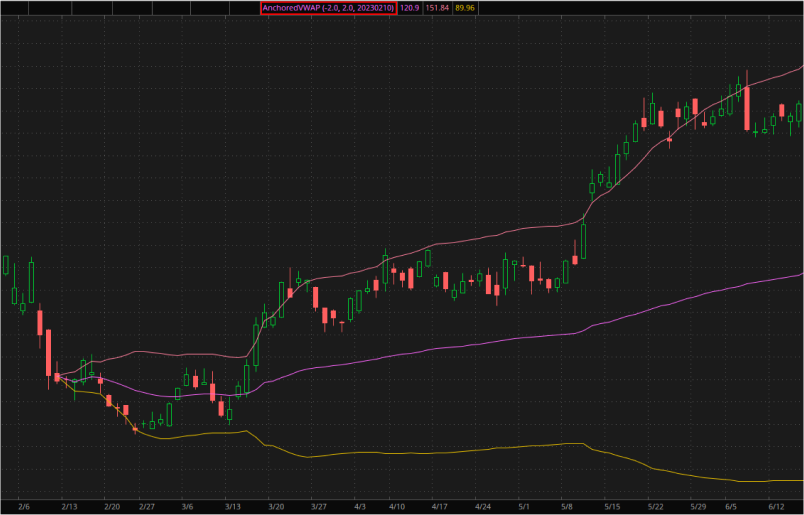

Description

AnchoredVWAP is a variation of the VWAP study that uses an anchored date to calculate the volume-weighted average price of a security. By analyzing cumulative VWAP data from the initialization point onward, it validates how a price has evolved and allows to pinpoint specific market events.

AnchoredVWAP uses date annotation to define the study’s starting date. To change it, right-click any timestamp in the chart area or use the built-in date picker.

If you want calculations to reset daily, weekly, or monthly, use the VWAP study.

Input Parameters

| Parameter | Description |

|---|---|

num dev dn

|

The number of deviations defining the distance between AnchoredVWAP and the lower band. |

num dev up

|

The number of deviations defining the distance between AnchoredVWAP and the upper band. |

begin date

|

The starting date used for the calculations. |

Plots

| Plot | Description |

|---|---|

VWAP

|

The VWAP plot. |

UpperBand

|

The upper band plot. |

LowerBand

|

The lower band plot. |

Example*

*For illustrative purposes only. Not a recommendation of a specific security or investment strategy.

Past performance is no guarantee of future performance.